What is cloud-based accounting software for small businesses? Before answering that question, we need to look at why we need accounting software for small businesses in the first place.

For any business to work efficiently, you need accounting software that can handle all of your financial tasks effectively. From invoice generation to expense management to payroll, all accounting tasks being automated greatly helps businesses flourish. This helps scalability, flexibility, and productivity of workers.

There are desktop and cloud accounting software, and this article focuses on the latter. Verified Market Reports estimate the valuation of the Cloud Accounting Market Software to reach $4320 million in the year 2024.

Key Takeaways

In this article, we are going to be discussing all there is to know about cloud accounting systems. These are the following questions we’ll be answering.

- What is cloud-based accounting software?

- How does cloud-based finance software work?

- What are the benefits to small businesses of using cloud-based software?

- What are the differences between cloud-based and desktop accounting software?

- Does cloud-based software have more advantages?

What is Cloud-Based Accounting Software for Small Businesses

Cloud accounting software is software that is hosted on remote servers, much like the Software as a Service (SaaS) model. This is a SaaS solution that enables you to store all your financial information and conduct advanced finance functions over the cloud. Data is sent to a digital space called “the cloud,” where it is processed and returned to the user.

What is the cloud? Cloud refers to a collection of servers that can be accessed through the internet, and hosts infrastructure and software. This is useful for businesses because a cloud-based accounting system allows the data to be put into the cloud, stored, processed, and sent back to the user safely.

Since the financial data is not stored in a physical location but rather in a remote digital space, you can access the data from any device, at any time.

Remote server storage offers optimized, streamlined solutions for your business, which desktop accounting software cannot promise.

How does Cloud Accounting Work for Small Businesses

The first thing to dissect is how cloud accounting works for small businesses. Let’s analyze what cloud-based software means.

1. What does Having Cloud-Based Software Mean

Having cloud accounting software for small businesses means that the company doesn’t have to set up separate desktops or computers to access or work on data. This is a web-based software specifically designed to streamline accounting processes.

2. What is the Cloud

The cloud is a digital space. It’s a network of servers and interconnected internet infrastructure where data can be stored and accessed according to the user’s needs.

3. How Can the Business Operate Better Using Cloud-Based Software

All the teams in the company, including finance teams and small business owners, can access the data from any device from their locations.

This makes collaboration efficient, makes the workers more productive, and allows different parts of the accounting process to be streamlined and made more scalable, and cost-effective.

4. How Can this Data be Accessed

The data can be accessed using the internet or through a cloud application service provider. Keeping your accounting software in the cloud has lots of benefits, which we will be discussing in the sections below.

What is the Difference Between Cloud Accounting and Desktop Accounting Software

Even though cloud-based and desktop accounting are both accounting software, there are fundamental differences between the two.

The differences boil down to how much the software costs, how the data operates, where the data is stored, how secure each method is, and the scalability of each method.

| Feature | Cloud Accounting | Traditional Accounting |

|---|---|---|

| Where is the data stored? | Data is stored on the cloud and is accessible all the time. | Data is stored on specific desktops. |

| Cost | You only pay for services that you need. No upfront costs. No need to invest in hardware. | More costs, you need to invest in hardware. |

| Scalability | You can easily upgrade your plan once your business keeps growing. This is very scalable. | You will need to keep adding or upgrading the software according to your growing needs. |

| Security | Data is held in remote and secure data centers. | Data security is heavily reliant on manual protection (like passwords) |

| Collaboration | Collaboration is easy since data can be accessed from anywhere. | Collaboration is more difficult since data is limited to one desktop at a time. |

| Integration | Integration is easier with common tools used for automation. | Integration is more difficult because this works with only a handful of tools. |

| Storage and Reliability | Since cloud accounting software can be accessed anywhere on the internet, it’s more reliable and better suited for storage. | As discussed before, traditional accounting software only relies on storage on the physical device where the data is downloaded, making it less reliable. |

| Technical Support | Most cloud accounting software will come with 24/7 online tech | It’s more difficult to find support for traditional software, you usually |

| Support | have to wait 24 hours. | |

| Updates | Updates are regular and automated | You’ll usually have to purchase a more expensive version for updates. |

| Audit Trails | Audit trails are limited, which lessens the complexity | Frequent audit trails |

Popular cloud-based accounting software includes FreshBooks, QuickBooks, Xero, and Financfy.

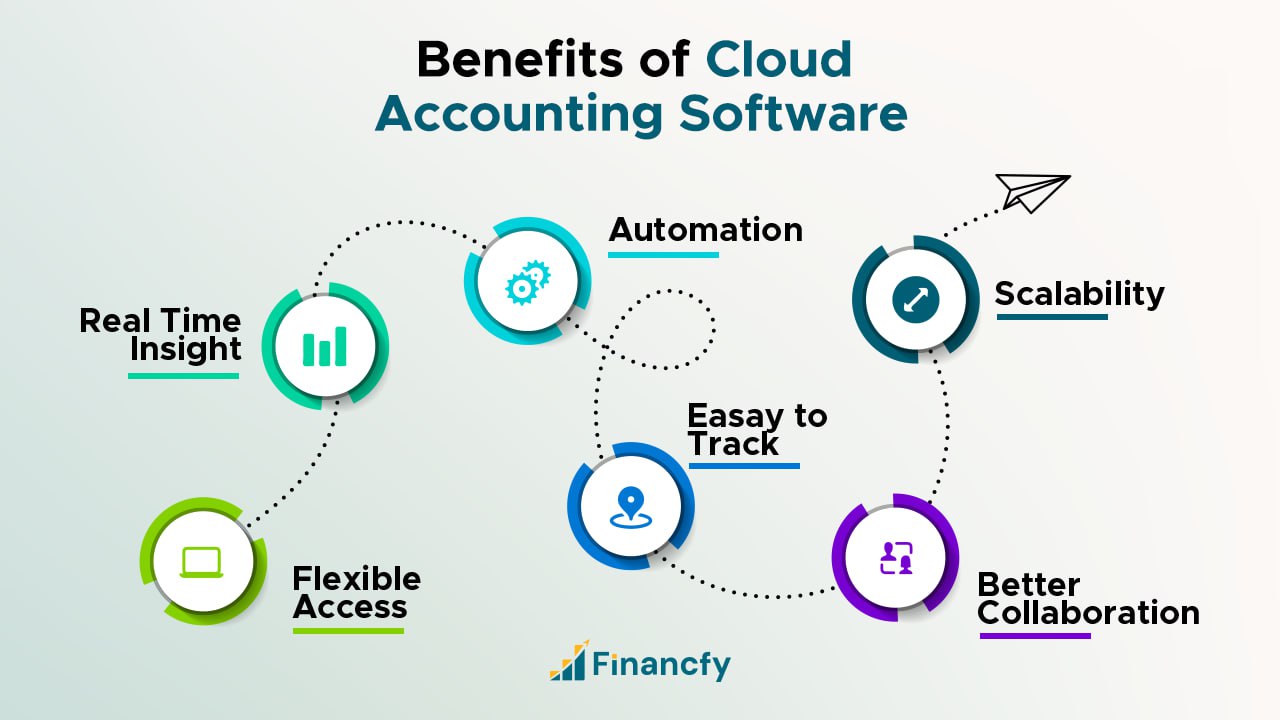

Benefits of Cloud Accounting Software

In this section, we will be breaking down the key benefits of using cloud accounting software.

Cloud accounting software can make your businesses more efficient, can automate lots of relevant processes and can protect all your data better than desktop software.

Let’s break down the key benefits of cloud accounting software. Apart from this cloud software is easy-to-use accounting software compared to traditional.

1. Access your Accounts from Anywhere at Any Time of the Day

Regular software often comes with frequent updates and is also localized to specific devices like desktops.

With cloud based bookkeeping software, you don’t have to worry about that. You can access your data from anywhere, even on the go. You just need to have a stable internet connection to access the data.

Additionally, most cloud-based accounting software comes in the form of a mobile app. This allows you to access the software through your mobile as well, releasing restrictions on devices you can use to access your data.

You can log in through the internet, or your cloud provider’s address. Either way, makes things much easier!

2. Accessible for Real-Time Information

With desktop accounting software, you often have to look at historical reports. Many of these are weeks or months old.

Cloud based bookkeeping allows you to be up-to-date on all financial information. Real-time reporting gives you an instant overview of your company’s current finances!

This is immensely important for future planning, and for having a deeper understanding of your company’s current financial situation.

3. Automation

Automation is one of the most important benefits of having the best cloud accounting software.

Cloud accounting software will automate your menial accounting-related tasks, allowing you to save precious time. You do this by setting up workflows.

4. App Ecosystem

An open API (application programming interface) will open up the world of third-party apps and tools to expand and automate your workflow further. There are many specific apps you can look into once you have cloud finance software.

There are specific invoicing apps cashflow apps, or any other project or industry-specific management software to choose from.

The breadth of these apps exists only to make your work easier. You can get help from a bunch of different apps and tools to further automate and streamline your work, make the workflow more efficient, and save money and time.

4. Better Collaboration

A small business is not a one-man army. There are many specific subdivisions of your company that all work in tandem simultaneously to yield the best possible results for the business. That’s why it’s important to work in collaboration with everyone.

Cloud based bookkeeping and cloud finance software allow you to share data instantly with other members in other divisions of the company.

Do you need something from your accountant, or vice versa? You can easily share that data by generating reports quickly.

If you are looking for the best online accounting software, you may want to look at Financfy. It can manage your expenses and income, and help automate your workflow to save time.

5. Less Expense

Organizations that use cloud technology typically spend less than those that rely on desktop-based accounting software management. It is also time and cost-saving software.

Final Thoughts

Choose the right accounting software, especially in this digital era when the cloud accounting software market is expected to exponentially grow. There are many benefits to cloud accounting, most of which cannot be accessed through desktop accounting.

Cloud accounting is better for automation, collaboration, accessing your accounts from anywhere, and making your workflow efficient and cost-effective.

FAQ of Cloud Accounting Software

Is Cloud-Based Accounting Safe?

Yes! The cloud-based accounting software is safe. It is safer than desktop accounting software.

What are the examples of cloud-based accounting?

Financfy, FreshBooks, QuickBooks, etc are the best examples of cloud accounting software.

What is the easiest accounting software app to use?

Financfy, FreshBooks, Intuit QuickBooks Online, etc

Why does a small business need to switch to cloud-based accounting platforms?

Small businesses needs to switch to cloud-based accounting platforms to make their workflow automated, more scalable, and cost-effective

Is cloud-based accounting software more cost-effective than desktop accounting?

Yes, cloud-based accounting software is more cost-effective than desktop.

See all features

See all features