Single entry system is a bookkeeping method in accounting. There are two bookkeeping methods in accounting. One is a single-entry method and the other is a double-entry method.

In a single-entry system, every transaction is recorded only once into an account log. This method is simple and used by small businesses. One does not need high accounting knowledge to maintain this accounting system.

In this article, we’ll describe everything about the single-entry system in accounting. We will discuss the advantages and drawbacks of this bookkeeping method, as well as its features.

Key Takeaways

- Single Entry Method is a simple method for tracking transactions. Here, each transaction affects one account and is recorded only once.

- There are three types of single entry system available.

- The single entry system has advantages but it also has some limitations in terms of bookkeeping.

- The single entry system and the double entry system are two different accounting systems. They have some significant differences.

- A practical example will help you to easily understand the single entry system.

- There are various kinds of accounting software available that businesses can use to manage their financial information.

What Is Single-Entry Accounting System

Single-entry accounting is a basic method of recording financial transactions where each transaction is recorded only once into the accounting records.

In this method, each transaction affects only one account. For example, if you sell products, The selling products would typically be recorded as a cash receipt when the sale is made. The system does not track the corresponding decrease in inventory or the increase in revenue as in a double-entry system. Instead, it focuses on the cash aspect of the transaction.

Transactions are typically recorded in a single-column format, with details such as date, description, and amount. Single-entry accounting provides a simple approach to the bookkeeping of transactions.

It is suitable for businesses without complex financial transactions. This system provides a basic overview of the financial activity of a business. However, it may not accurately represent the financial performance of a business.

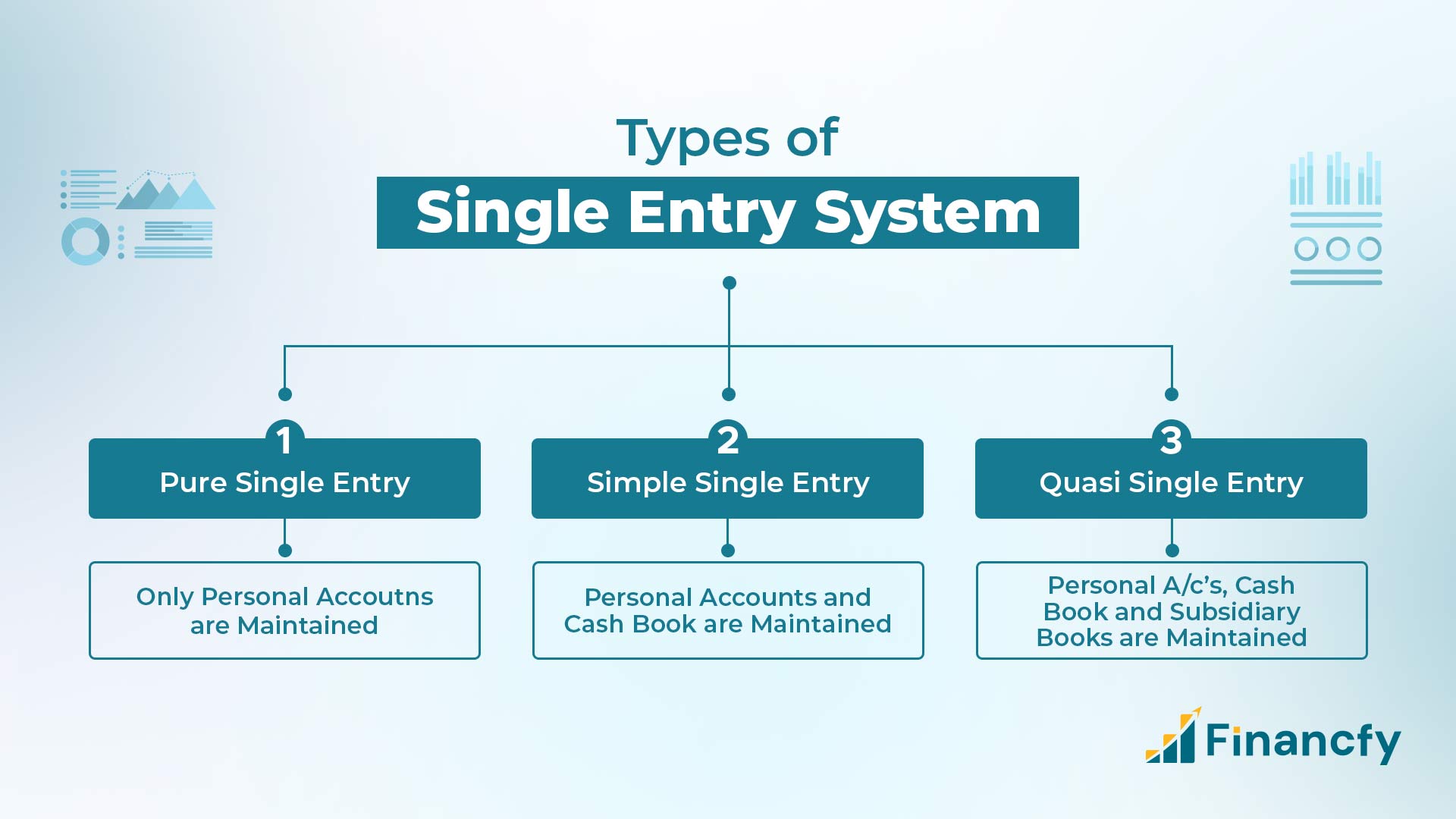

Types of Single Entry System

The single-entry accounting system is classified into three distinct types:

1. Pure Single Entry System

In the pure single entry system, only personal accounts are considered to record. There is no record available for sales, purchases, or cash and bank balances.

2. Simple Single Entry System

In this system, bookkeeping is conducted based on a double-entry framework. But it focuses on only two accounts: the personal account and the cash account.

As a result, transactions are recorded just from these accounts. There is no consideration for any other accounts.

3. Quasi Single Entry System

Additional subsidiary accounts are also maintained in the quasi-single entry system alongside the personal and cash accounts.

These include accounts for sales, purchases, and bill books. Essential information like wages, rent, and salaries is also recorded. This system serves as an alternative for the double-entry accounting system.

Example of Single Entry System

Let’s look at an example on how transactions are recorded in a single entry system.

Let’s assume you are an owner of a small business. You sell shirts and at the beginning of the month (May) you had $15000 as your cash balance. Now the following transactions occurred during the month:

- 5th May, Sold 10 shirts for $3000.

- 15th May, Purchased a table for your business for $200.

- 20th May, Paid utility bills for $450.

- 23rd May, Sold 7 Shirts for $1800.

- 25th May, Invoice paid by Smith for $2500.

- 28th May, Sold 20 shirts for $5000 in check and submitted to the bank.

- 31st May, Paid wages for $2200.

Now, the account book will look like this:

| Date | Description | Income | Expense | Balance |

|---|---|---|---|---|

| May 1st | Starting Balance | $15000 | ||

| May 5th | Sale | $3000 | $18000 | |

| May 15th | Purchase Table | $200 | $17800 | |

| May 20th | Utility Bill | $450 | $17350 | |

| May 23rd | Sale | $1800 | $19150 | |

| May 25th | Invoice paid by Smith | $2500 | $21650 | |

| May 28th | Bank | $5000 | $26650 | |

| May 31st | Wages | $2200 | $24650 | |

| May 31st | Ending Balance | $24650 |

Explanation:

- 5th, 23rd May – When you sold the products you received cash, that is why the sale went into the Income column and added to the balance.

- 15th May – When you purchased the table, you paid cash. The cash decreased here. So, it went to the Expense column and deducted from the remaining balance.

- 20th, 31st May – The same thing goes for the Utility bill and wages. Both are expenses of the business, went to the Expense column and were deducted from the balance.

- 25th May – A payment received from an invoice that was paid by a customer. So, cash increased here and added to the balance.

- 28th May – Check payment was received for the sale. As it was submitted to the bank, the bank balance increased. So, an account for the bank was recorded, went to the Income column and added to the balance.

In a double entry system bank balance and cash balance are recorded differently. It gives a clearer picture of cash flow.

At the end of the month you have $24650 as the final balance. You can now repeat the process for the next month, using this as the starting balance.

Advantages of Single Entry System

- Single-entry accounting system provides a straightforward approach to recording financial transactions. So, it is easily accessible to individuals with limited accounting knowledge.

- The single-entry system is comparatively less time-consuming. As there is only one entry required for each transaction, single-entry accounting is significantly faster to maintain.

- This system is best suited for businesses with sole proprietorship. Especially businesses that have simple financial transactions.

- The single-entry system is cost-effective as it requires less time and expertise to maintain. Therefore, this system is preferable for new startup businesses with limited resources.

- As it does not record complex financial transactions, there is less risk of errors and confusion.

- There is no need for specialized accounting software to maintain single-entry bookkeeping. Simple tools like spreadsheets, Excel, or any simple accounting software are enough to record transactions with this method.

- It provides a basic overview of the financial health of a business.

Disadvantages of Single Entry System

- One of the primary drawbacks of the single-entry system is its limited ability to provide accurate and detailed financial information of a business.

- Single-entry accounting systems does not work well for large businesses with complex financial transactions.

- The single-entry system does not provide detailed financial reporting. Businesses may struggle to generate essential reports like balance sheets and income statements with this system.

- This system is prone to errors as one entry is recorded for each transaction.

- It’s harder to track assets & liabilities as the single entry system focuses on cash transactions. Therefore, businesses may find it difficult to maintain accurate records of inventory, accounts receivable, and accounts payable.

- The absence of detailed financial information limits business owners’ ability to make informed decisions.

- It is not accepted by tax authorities as it does not provide complete financial information.

- It is impossible for auditors to verify the accuracy of the financial statements in a single-entry system. The information must be converted into a double-entry format to conduct an audit.

Single-Entry Vs Double-Entry Accounting

The key differences between single entry system and double entry system are:

- Record:

In a single-entry system, each transaction is recorded once. In a double-entry system, every transaction is recorded twice, as a debit and a credit. - Accuracy:

Single-entry system provides limited detail and may lack accuracy. Double-entry system provides accurate and detailed financial information through balancing equations. - Cost-effectiveness:

Single-entry system is cost-effective, less time-consuming and easy to maintain. Double-entry system is more expensive and time-consuming. - Accounting Knowledge:

There is no need for high accounting knowledge to maintain bookkeeping in a single-entry system. Double entry bookkeeping system requires high knowledge of accounting and expertise. - Business:

Single-entry system is suitable for small businesses with simple transactions. Double-entry system is suitable for larger businesses with complex financial operations. - Software:

The implementation of a single-entry system does not require specialized accounting software. A simple spreadsheet or any simple accounting software would do the thing. Double-entry accounting system requires specialized accounting software and expertise to use it. - Report:

In a single-entry system, it is difficult to generate detailed financial statements. Double-entry system provides comprehensive financial reporting, including balance sheets and income statements. - Principles:

Double-entry system is based on accounting standards and generally accepted accounting principles (GAAP). Single-entry system does not follow any set of rules. - Error:

Single-entry system is prone to error. It is hard to identify fraudulent activity with this system. The double-entry system makes it easy to find errors and frauds because the balances on both sides must match. - Data:

Single-entry system cannot provide enough data to make informed decisions for businesses. Double entry system provides comprehensive financial reports. Based on them businesses get insights of their financial performance and make informed decisions

Final Thoughts

We can see that a single-entry accounting system might be helpful to small businesses that do not need to keep complex transactions. But as the business grows the financial transaction will become more complex. Then it might need to convert into the double entry system to manage transactions properly.

The good thing is that you can convert the single-entry system into the double-entry system anytime. To do this, you might need the help of a professional accountant or a bookkeeping expert.

Investing in the proper accounting system can help you track your finances more effectively. So, evaluate your accounting practices and consider whether single-entry or double-entry accounting is the right fit for your business.

FAQ

What are the types of single-entry accounting systems?

The main three types of single-entry accounting systems include-

- Pure Single-Entry System

- Simple Single-Entry System

- Quasi Single-Entry System

Who uses single-entry bookkeeping?

Single-entry bookkeeping is commonly used by small businesses, freelancers, sole proprietors, and individuals with straightforward financial transactions.

It’s the best bookkeeping method for businesses that use cash basis accounting over accrual accounting and have simple financial transactions.

Is the single entry system effective or not?

Single entry accounting system is effective for small businesses with simple finances.

It is cost-effective and easy to learn & implement. But it may not provide enough detail for larger or more complex financial operations.

Why single entry is replaced by a double entry system?

In a single entry system, transactions are recorded only once and it is prone to error.

Double-entry system provides more accurate and detailed financial information, which makes it better suited for businesses with complex transactions.

What are the three golden rules of accounting?

The three golden rules of accounting are:

- Debit the receiver, credit the giver.

- Debit what comes in, credit what goes out.

- Debit all expenses and losses, credit all income and gains.

See all features

See all features