Accounting system is the backbone of any successful business. Organizations & businesses of all sizes use different kinds of accounting systems to manage their financial data. As there are different kinds of accounting systems, picking the right one for the specific business is crucial.

In this article, we will explain what are the different types of accounting systems. Also, we will be describing the accounting processes & methods businesses use to record their financial data.

Key Takeaways

- Accounting system is a process to record all the financial transactions of a business like the revenues, expenses, inventory, taxes, and payroll and generate financial reports.

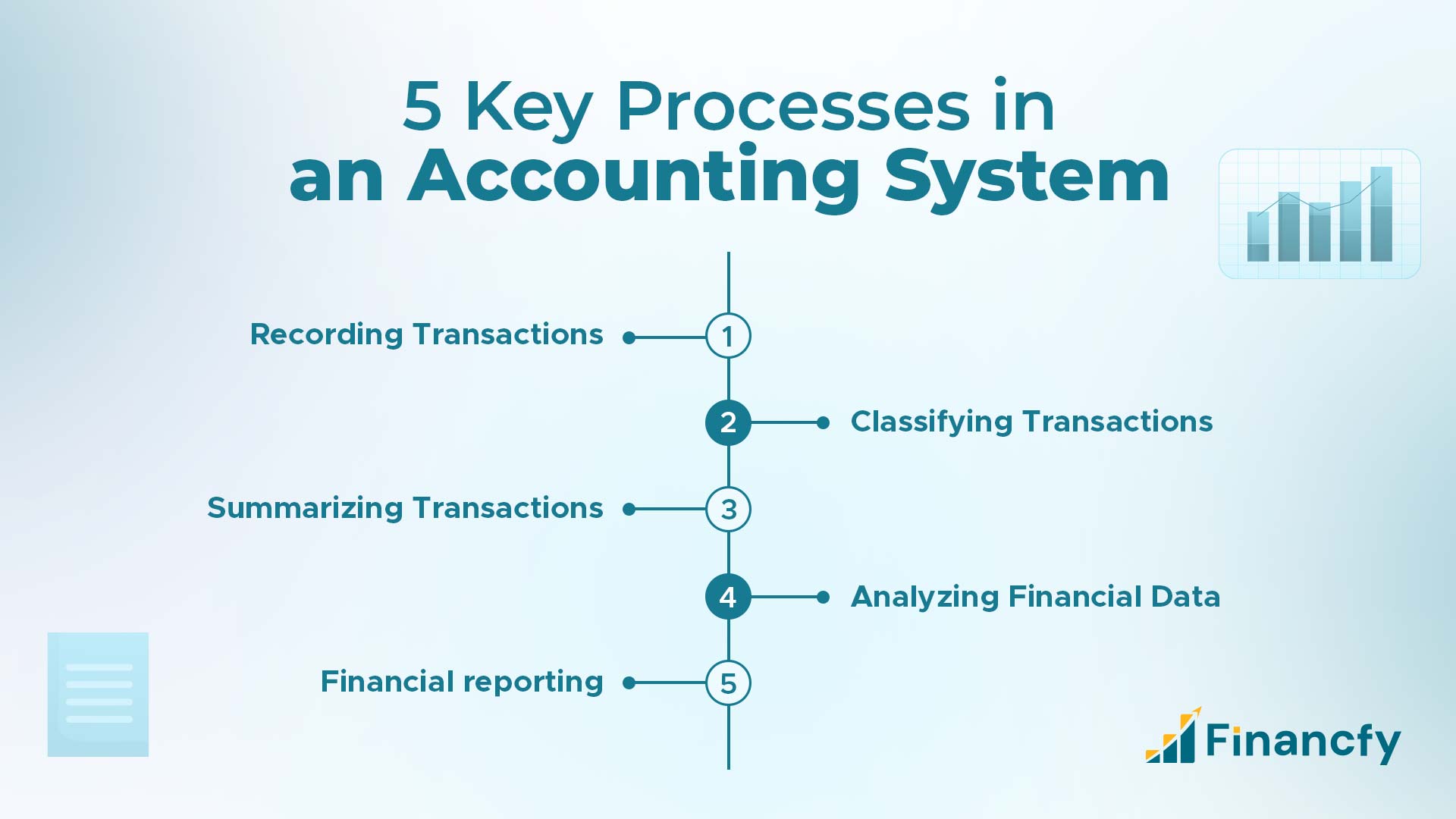

- The five processes of an accounting system are Recording, Classifying, Summarizing, Analyzing and financial reporting.

- Single-entry system and Double entry system are the two types of bookkeeping in the accounting system.

- Financial transactions can be recorded in 4 different accounting systems. Those are Manual, Computerized, Cloud-based, Enterprise Resourcing Planning (ERP).

- The financial transactions are mainly recorded in two methods of accounting. The Cash method and the Accrual method.

- There are various kinds of accounting software available that businesses can use to manage their financial information.

What is an Accounting System

Accounting system is a process that records all the financial information of a business. Professional accountants use accounting systems to keep track of income, expenses, taxes, inventory, sales, & payroll.

They can do it manually with pen and paper or use digital tools to keep the records. An accounting system helps accountants in financial management by creating proper financial reports. It provides insights into a company’s financial health, facilitates informed decision-making with accurate data.

What is the Use of an Accounting System

Businesses use accounting systems to organize and record financial information accurately. Here are the use cases of an accounting system:

- Record-keeping financial transactions

- Financial reporting

- Decision making

- Compliance with regulatory requirements and tax laws

- Budgeting and planning

- Monitoring financial health

What are the Processes of an Accounting System

There are several key processes in an accounting system to ensure accurate financial records & reports. The processes are a systematic approach to manage financial data. The process is tracking & recording financial data and generating reports.

Here, information like sales invoices & receipts works as the input data to generate balance sheet reports and income statements. Business authorities make crucial decisions based on those financial reports.

The five key processes in an accounting system:

1. Recording Transactions

The primary step is documenting all financial transactions. Transactions may include sales, purchases, expenses, loans and investments.

2. Classifying Transactions

After recording, transactions are classified into appropriate categories based on their nature.

The common categories are assets, liabilities, equity, income, and expenses. Proper classification is needed to determine the accurate financial position of the business.

3. Summarizing Transactions

The third step is to summarize the transactions into financial statements such as the balance sheet, income statement, and cash flow statement.

It is to provide a clear overview of the business’s financial health to the stakeholders.

4. Analyzing Financial Data

Analyzing the financial reports is a crucial aspect of the accounting process.

Business owners assess the financial data to make informed decisions, identify errors & areas for improvement, and plan for the future.

5. Financial Reporting

The last thing to do in this process is financial reporting. The financial reports are distributed to stakeholders, such as investors, creditors, lenders, and regulatory authorities. Stakeholders can assess a business’s stability, profitability, and prospects through this.

Different Types of Bookkeeping in Accounting Systems

There are two types of bookkeeping in accounting systems.

One is Single-Entry Bookkeeping and the other is Double-Entry Bookkeeping.

It’s important to choose a specific bookkeeping method.

Single-Entry Bookkeeping

Single-entry bookkeeping is a very simple way to record data in an accounting system. It can be done in both pen & paper or with digital tools like spreadsheets.

There is only a debit or credit entry recorded on one side of the ledger in this system.

Transactions are recorded as either income or expenses. It is easy to track cash flow but less detailed than other systems.

Single-entry bookkeeping is best suited for small businesses and those who don’t have complex financial records.

Here is an example of how a single entry bookkeeping may look like:

| Date | Particulars | Income | Expense | Tax | Balance |

|---|---|---|---|---|---|

| 02/03/24 | Colour Box | $50 | - | $3 | $4550 |

| 04/03/24 | Utility Bill | - | $200 | $4350 |

Here, when a sale occurred, the data went into the “income” section and added to the balance.

And when an expense occurred, the data went straight into the expense section and was deducted from the balance.

Once a transaction happens, the amount will be added or deducted from the previous balance and added into the “Balance” section.

Double-Entry Bookkeeping

In double-entry bookkeeping, two entries are recorded for each transaction.

One will be debited and the other credited.

This method gives more accuracy & reliability in creating financial statements. It is widely used in larger businesses needed with detailed financial analysis.

| Date | Particulars | A/C No. | Debit (Dr) | Credit (Cr) | |

|---|---|---|---|---|---|

| 5 May, 2024 | Assets Cash | 305 | **** | **** | |

| Purchase asset in cash | |||||

If we look at this example of “buying an asset” – The asset is recorded as debit and the cash as credit. Because the assets increased here in exchange for cash, which decreased.

Types of Accounting Systems

Mainly 4 types of accounting systems available today. These systems are designed to help businesses manage their financial information. Each one has its own characteristics and advantages.

It is crucial to choose the right accounting system according to the business needs. Now, let’s see a broad view of the 4 types of accounting systems:

Manual Accounting System

Manual accounting system means recording financial data by hand, using pen & paper in a general ledger. There is no need for a computer, accounting software or any complex systems. A physical ledger records the financial transactions in the order of events. Transactions are recorded & verified from the physical invoices and receipts.

Manual accounting system is cost-effective and easy to understand. This system is suitable for small businesses with limited transactions. The downside of this system is that it is very time consuming and error-prone than the other accounting systems.

Computerized Accounting System

A computerized accounting system uses accounting software to automate the transaction recording process and produce financial reports. This system provides faster data entry, real-time updates, and accurate reporting.

There are various types of accounting software available with different kinds of features. The accounting software is customizable according to business needs. This accounting software is easy to use with intuitive interfaces and helpful tutorials or customer support to help users manage their finances effectively.

The computerized accounting system has various accounting features like invoicing, payroll processing, managing accounts payable and inventory management. This system is suitable for businesses of all sizes.

Cloud-Based Accounting System

Cloud-based accounting system is also a computerized system where financial data is stored on remote servers accessed via the internet. This system allows users to access their financial information from anywhere, at any time.

Cloud-based accounting software can be integrated directly into bank accounts. So, whenever a payment is made or received, the particular entries will be created and assigned to the appropriate accounts automatically.

Cloud-based accounting systems can do invoicing, generating financial reports, calculating sales tax, reminding & processing payments, and many other things. This system is particularly beneficial for businesses of all sizes, especially, businesses with multiple locations.

Enterprise Resource Planning (ERP) System

An ERP system is an integration of various business processes including accounting. An ERP system is used to manage inventory, processes in finance, procurement, project management, risk management, and various other tasks.

This system helps to run an entire business. But it is really expensive. ERP systems are typically used by large industries & organizations with multiple departments and complex financial needs.

What are the Two Different Accounting Methods

There are two main types of accounting methods in the accounting system.

One is Cash-based accounting and the other is accrual-based accounting.

Let’s broadly see them:

Cash-Based Accounting

In a cash accounting method revenue and expenses are recorded when cash is received or paid out. Cash accounting method is straightforward and easy to understand. It is preferred by very small businesses.

But to carry out this method, a business must have all the transactions in cash. If a business makes sales or purchases on credit then it might not provide an accurate representation of the financial position.

Accrual Based Accounting

In accrual accounting revenue and expenses are recorded when they are earned or incurred. Not when the cash is received or paid. This method provides a more accurate picture of a business’s financial performance.

Accrual basis accounting is required to comply with the Generally Accepted Accounting Principles (GAAP). This method is commonly used by larger businesses and organizations.

So, which of the two accounting methods a business should choose to use?

If it is a small business with a sole proprietor, it can use Cash based accounting. But all the transactions must be carried out in cash. Otherwise, in credit transactions the business will be forced to use accrual based accounting.

Ultimately, it is best to use Accrual based accounting. It is required by the GAAP and gives a clear report of the financial condition of the business.

In the US, there is a law of the Internal Revenue Service (IRS) about businesses maintaining the accrual method. It says businesses that have sales exceeding $5 million per year and their gross receipts exceed $1 million per year must use accrual accounting method. Maintaining an accrual method by using accounting software makes financial management a lot easier. It automates the whole accounting system.

Conclusion

Understanding the different types of accounting systems is essential for any businesses and industry.

Each of them has its own benefits and unique features to suit various business needs. For proper financial management, using a certain accounting system is necessary. And to make informed financial decisions choosing the right accounting system is crucial.

So, assess your business needs and acquire the best-suited accounting system to streamline financial processes, and enhance efficiency.

FAQ

What are the different types of accounting methods?

There are two types of accounting methods – Cash method & Accrual Method.

How do accounting systems work?

Accounting systems work by recording financial transactions and categorizing them into specific accounts such as assets, liabilities, income, and expenses.

After that, these transactions are summarized and analyzed to make financial reports that provide insights into a business’s financial health.

What are the objectives of accounting?

The five objectives of accounting are-

- Recording Transactions

- Classifying Transactions

- Summarizing Financial Data

- Analyzing Financial Information

- Aid in Decision Making

Who are the users of accounting?

The internal users of a business are owners, managers, and employees. And the external users (individuals not associated with the business) are suppliers, banks, customers, investors and tax authorities.

What are the different accounting systems?

The two accounting systems are-

- Single-entry system

- Double-entry system

What does an accounting system do for a small business?

Using an accounting system helps manage financial books and saves time for small businesses.

An accounting system helps a small business manage financial tasks, such as tracking income and expenses, generating reports & statements, and ensuring data accuracy in financial records.

See all features

See all features