Bookkeeping is a process to record the financial transactions of a business. There are two methods available for bookkeeping.

One is single-entry bookkeeping, where only one entry is recorded for each transaction.

And the other is double-entry bookkeeping, similar to a detailed ledger system. Here, every transaction has two entries recorded: a debit and a credit.

Understanding the difference between single-entry and double-entry bookkeeping is crucial. Because a business must choose either one of them as its accounting system.

In this accounting guide, we’ll discuss everything about single-entry and double-entry bookkeeping. We will describe the key differences between these two bookkeeping methods and which one is best for your small business.

Key Takeaways

- There are fundamental differences between single-entry and double-entry bookkeeping methods.

- Both of the methods have their own advantages and limitations. You have to choose either one of them according to your business needs.

- Check out the examples and scenarios to illustrate the practical application of both methods.

- Choose the best-suited method based on the size and complexity of your business.

What is Single Entry Bookkeeping

Single-entry bookkeeping is an accounting system to records the financial information of a business. It is a simple & straightforward method of tracking financial transactions, where each transaction is recorded only once.

This method does not require high knowledge or expertise in accounting to track transactions. So, the single-entry accounting system is best suited for small businesses with sole proprietorships. Where it is not necessary to maintain complex transactions.

This accounting system only records revenues and expenses. It does not keep the records of assets, liabilities, owners equity.

Without recording this financial information you cannot create financial statements. Also, Journals, Ledgers and Trial Balance are not prepared in this system.

How does Single-Entry System Work

Each transaction is only recorded once into your cash book. The recording format may include date, description, amount transaction and final balance.

The recording process starts with the existing cash balance you have. Then, if you receive cash from sale you add the amount and if you pay for something you deduct it from the balance.

After each transaction, you will get the final balance that is in your hand. The transactions are only recorded when you receive or pay in cash. Not when the transactions occurred or earned.

Single Entry Accounting Example

Now, let’s assume you have $10000 as cash balance at the beginning of March. And you are the owner of a small business. Here are some transactions that occurred during the whole month.

- On 5th March, you paid rent $3000.

- On 10th March, you sold products worth $2500 in cash.

- On 15th March, you bought a TV for business for $1000 in cash.

- On 25th March, a customer paid an invoice for $3200.

Now, the single-entry system cash book will look like this:

| Date | Description | Income | Expense | Balance |

|---|---|---|---|---|

| March 1 | Starting Balance | $10000 | ||

| March 5 | Paid Rent | $3000 | $7000 | |

| March 10 | Sale | $2500 | $9500 | |

| March 15 | Supplies | $1000 | $8500 | |

| March 25 | Invoice Paid (Sale) | $3200 | $11700 | |

| May 31st | Ending Balance | $11700 |

Explanation:

When you paid the rent, it went into the expense column and was deducted from the starting balance.

Then you receive cash from selling products, which is an income. So, it was recorded as an income and added to the remaining balance.

The same thing goes for the other two entries.

And at the end of the month the final balance is $11700, which is in your hand or in a bank account.

What are the Advantages and Disadvantages of a Single-Entry System?

Advantages of Single Entry Bookkeeping System

- The Single-entry bookkeeping system offers simplicity, clarity, and effortless maintenance. It does not require high accounting knowledge to keep records. That’s why this system is preferred by small business owners and those who can’t afford to hire an accountant.

- It is less time-consuming than the double-entry bookkeeping system.

- Suitable for small businesses without complicated financial information.

- It is cost-effective and does not require any complicated accounting software.

- This system provides a basic overview of the cash flows of a business or personal account.

- A little training is required to implement the single-entry system.

- Single-entry systems can be converted to a double-entry system as the business grows.

Disadvantages of Single Entry Bookkeeping System

- Single entry system provides limited information. So, it is not enough to assess the financial health of a business.

- It cannot provide the information of assets, liabilities, and equity of a business.

- You cannot expect detailed financial reports such as trial balances and balance sheets.

- Single-entry bookkeeping systems do not follow generally accepted accounting principles.

- Unable to record complex transactions such as depreciation or inventory management.

- It’s difficult to detect errors and fraud in a single-entry system.

- Less reliable than the double-entry bookkeeping system.

What is Double Entry Bookkeeping System

Double-entry bookkeeping system is a financial transaction recording method developed by Luca Pacioli, in 1494.

Transactions are recorded into two accounts in this system, one as a debit and the other as a credit. Each transaction always impacts two accounts.

This system shows information on the assets, liabilities and equity of a business. Double-entry accounting system provides a complete overview of a business’s financial performance. It is popular among businesses of all sizes.

How does the Double-Entry Bookkeeping System Work

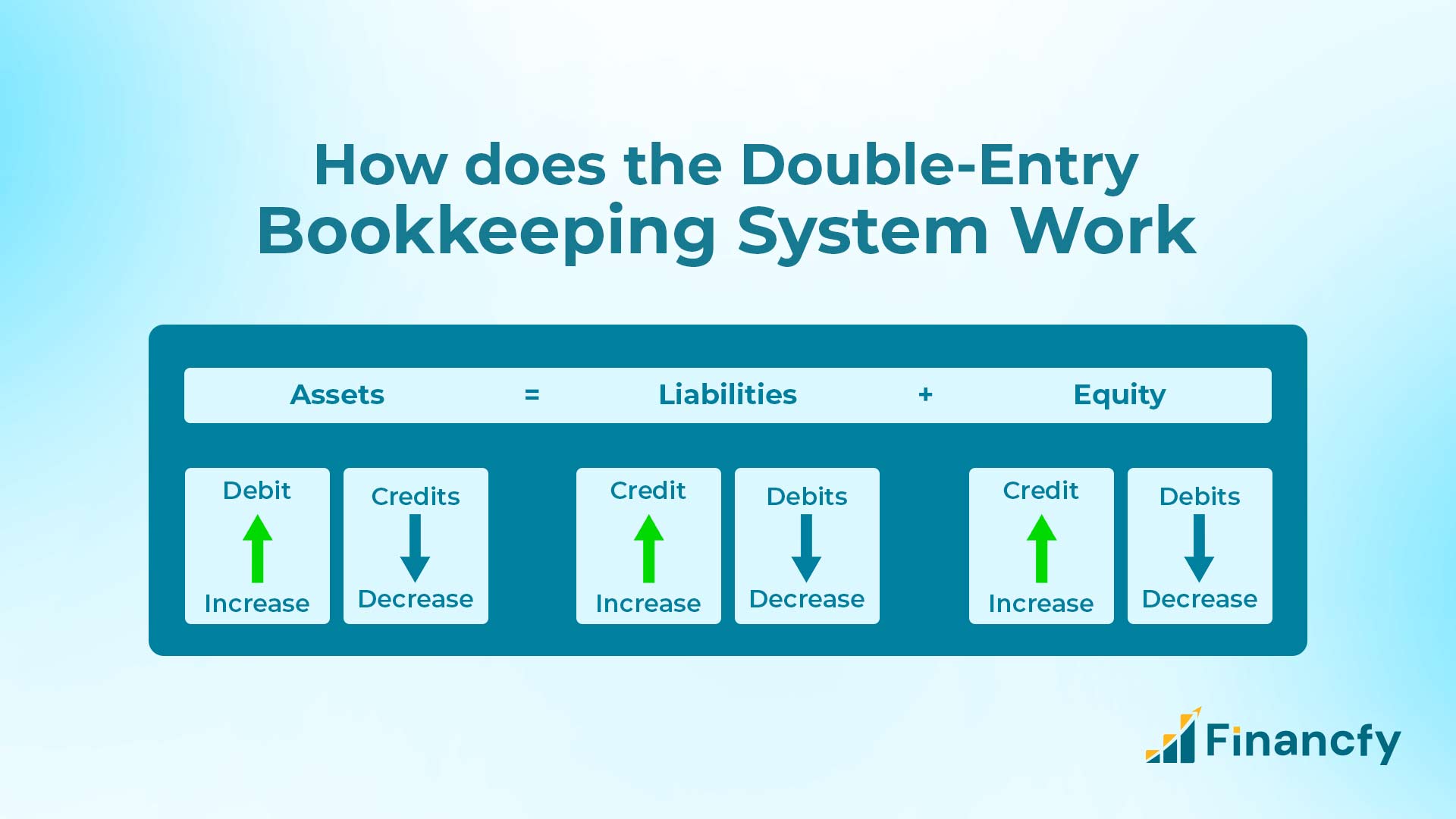

Double entry bookkeeping system follows the principle that every debit must have an equal and opposite credit. The accounting equation it is based on is:

(Assets = Liabilities + Owner’s Equity) or (A = L + OE)

Here,

- Assets are the money that the business owns.

- Liabilities are the things that the business owes.

- Owner’s equity is the business owner’s investment in the business.

- Income is the money that business earns by selling products.

- Expense is the money that business spends in many ways to run the business.

In a double-entry system, the transactions are recorded when they occur. Not only when the cash is received or paid.

The transactions will always affect at least two accounts. The debit and the credit side must always balance out.

Like when you purchase an inventory with cash, the inventory account will be debited to increase its value. And the cash account will be credited to decrease its balance with the same amount.

This dual-entry method ensures that the books remain balanced and accurate.

Double Entry Accounting Examples

Now, let’s have a look at an example of double-entry bookkeeping. Assume you are the owner of a service-oriented business. Here are the transactions that took place in April:

- On 3rd April, you bought a table of $150 for your office.

- On 7th April, you provided service to a customer for cash $1200.

- On 12th April, You paid rent for $2000.

- On 18th April, A customer paid $1500 directly into your bank account. It was a bill dated 13th April.

Now, the double-entry bookkeeping sample will look like this:

| Date | Particulars | Ref | Debit (Dr) | Credit (Cr) |

|---|---|---|---|---|

| April 3, 2024 | Table Cash | $150 | $150 | |

| April 7, 2024 | Cash Service | $1200 | $1200 | |

| April 12, 2024 | Rent Cash | $2000 | $2000 | |

| April 18, 2024 | Bank Accounts Receivable | $1500 | $1500 | |

| Total | $4850 | $4850 |

Explanation:

In April 3, when the table was bought, the asset increased and cash decreased. So, the table was recorded as a debit and credited the cash.

In April 7, you provided services in exchange for cash. So, the cash increased and was debited and the service account was credited.

The same thing goes for the April 12 transaction of rent paid. Cash decreased so it was credited and Rent was debited.

April 18, the customer paid directly into the bank, so the bank balance increased and was recorded as a debit. As it was an accrued transaction, the accounts receivable decreased and got credited.

In the final balance, we can see the total debit and the total credit are the same. This will always match cause that’s what duality means.

What are the Advantages and Disadvantages of a Double-Entry System?

Advantages of Double Entry Bookkeeping System

- Double entry system provides a complete and accurate overview of the financial health of a business.

- Provides financial statements like trial balance, ledger, balance sheet, and income statement.

- Easy to track complex transactions such as depreciation and inventory management.

- This system follows generally accepted accounting principles (GAAP) and accounting standards.

- A very less chance of fraud and errors.

- Easy identification of errors reducing the risk of financial inaccuracies.

- Provides a clear and transparent record of financial transactions

- Businesses can take informed decisions with detailed financial information.

- Suitable for businesses of all sizes.

Disadvantages of Double Entry Bookkeeping System

- It requires more accounting knowledge to maintain the double-entry bookkeeping system.

- It is more complex and time-consuming than the single-entry system.

- To maintain a double entry bookkeeping, it may require a specialized accounting software.

- Requires additional training for business owners and employees to understand the implementation of the double entry system.

- The complexity of this system may lead to potential errors.

- As the business grows the transactions become more complex.

- It is more expensive than a single-entry accounting system.

Key Differences Of Single-Entry and Double-Entry Accounting System: Single-Entry Vs Double Entry

In the pure single entry system, only personal accounts are considered to record. There is no record available for sales, purchases, or cash and bank balances.

| Particulars | Single Entry Accounting | Double Entry Accounting |

|---|---|---|

| Method of Recording | Each transaction is recorded once | Every transaction is recorded twice (Once as debit and other as credit) |

| Complexity | Simple and easy to maintain | More complex and structured |

| Accuracy | Prone to errors and frauds | Provides greater accuracy and reliability |

| Financial Insight | Limited insight into financial position | Provides a comprehensive insight of the financial health |

| Error Detection Ability | Limited ability to detect errors | Has excellent ability for identifying and fixing errors |

| Suitability | Suitable for small businesses with sole proprietor | Suitable for businesses of all sizes, especially medium to large sizes. |

| Cost | Generally cost-effective. Lower initial setup and maintenance costs. | Costlier than the single entry system. Higher initial setup and maintenance costs. |

| Financial Reporting | Has limited financial reporting capabilities | Provides detailed financial reporting |

| Regulatory Compliance | Does not follow accounting standards | This system follows accounting standards |

| Decision-Making Support | Limited support for decision-making | Provides valuable data to take informed decisions |

| Scalability | Difficult to accommodate as the business grows | Can easily accommodate with business growth |

| Training Requirement | Minimal training required | Requires more extensive accounting knowledge & training |

| Record Keeping | Less detailed record-keeping | Keeps a detailed record of transactions |

| Financial Analysis | Limited capabilities for financial analysis | Provides enough insights for in-depth financial analysis. |

| Tools | Does not require any specialized software | Requires specialized accounting software |

| Completion | It is an incomplete accounting system | It is a complete accounting system |

| Accounts | Maintains personal and cash accounts | Keep records of all kinds of accounts |

Single-Entry Vs Double-Entry: Which Accounting System Is Best for your Small Business

As we can see, there are significant differences between single-entry and double entry bookkeeping systems. Both of them have their advantages and drawbacks.

Single-entry system is cost-effective and easier to maintain. But it’s not the best option for recording all kinds of accounts. On the other hand, the double-entry system offers comprehensive features to record all kinds of accounts of a business. But it is a little expensive and requires more knowledge of accounting.

Single-entry system cannot provide necessary insights of the financial performance of a business. It does not produce reports like a ledger, trial balance, or balance sheet. So, it’s not a complete method for the accounting system of a business. Also, the single-entry system cannot keep up with the business’s growth.

Double-entry system continuously provides valuable insights into the financial health of a business. It helps to produce all types of financial reports like the ledger, trial balance, and balance sheet. The financial reporting aids in making informed decisions for the business. So, we can say that it is a complete method.

As the business grows this method can keep up with the complex transactions. This accounting system needs you to acquire higher accounting knowledge or employ a professional accountant to maintain bookkeeping.

So, if your small business does not expect to grow and there is no presence of complex financial transactions, it is best to choose the single-entry method. It can save you time and costs.

But if you want to grow your business gradually over time, you must follow the double-entry method.

As business grows financial transactions become more and more complex that single entry method cannot keep record. With the double-entry method, you will be able to make the right financial decisions for the business to ensure its success.

Final Thoughts

We hope now you know which bookkeeping method is best for your small business. The choice between single-entry and double-entry accounting systems ultimately depends upon the specific needs of your business.

Single-entry accounting offers simplicity but lacks accuracy. In contrast, double-entry accounting provides detailed and accurate data but requires knowledge, time and costs.

Understanding the differences will help you to choose either one of them depending on your business size & requirements. Whether you choose single-entry or double-entry accounting, the goal is to maintain accurate and up-to-date financial records.

See all features

See all features